Unpacking Robert Kiyosaki: Wealth Principles, Controversies, And What You Should Know

Detail Author:

- Name : Mrs. Ilene Deckow Jr.

- Username : oschulist

- Email : genevieve.kub@yahoo.com

- Birthdate : 2006-07-29

- Address : 2169 Calista Springs West Hayden, GA 21600

- Phone : (551) 951-4484

- Company : Zulauf-Thiel

- Job : Retail Salesperson

- Bio : Natus explicabo odit quasi ipsa velit. Nihil rerum voluptatum quia atque. Mollitia est rerum at iste qui consequatur.

Socials

instagram:

- url : https://instagram.com/vhartmann

- username : vhartmann

- bio : Facilis aliquam minima ex cum. Doloribus et et minus aut. Dolore tenetur numquam laboriosam quia.

- followers : 6995

- following : 2546

linkedin:

- url : https://linkedin.com/in/vincenzohartmann

- username : vincenzohartmann

- bio : Enim qui et aliquam totam recusandae.

- followers : 5424

- following : 1780

For many people looking to get a handle on their money, the name Robert Kiyosaki often comes up. He is, arguably, a very influential author in the finance, real estate, and investing space, and his book, Rich Dad Poor Dad, has sold over thirty million copies and has been translated into forty languages. It really is a massive achievement, and his ideas have certainly shaped how a lot of us think about making money and building a good financial life.

I remember when I first read Rich Dad Poor Dad by Robert Kiyosaki, I was at first inspired and intrigued by his writing. It felt like a fresh perspective, a different way to look at how money works compared to what most of us are taught. He talks about things that just aren't discussed in regular schools, and that can be quite eye-opening for someone trying to figure out how to get ahead financially. You know, it really makes you think about money in a new light.

However, as I continued to read and learn more about Robert Kiyosaki and his approach, I grew a little skeptical. There are some aspects of his work and methods that can leave you feeling a bit uneasy, especially when it comes to the cost of some of his educational offerings. It's a bit of a mixed bag, to be honest, and that's something worth exploring for anyone considering his advice or courses. So, we'll talk about all of that, and more, as we go along.

Table of Contents

- Robert Kiyosaki: Who Is He?

- The Core of Kiyosaki's Philosophy: Assets Versus Liabilities

- The House as a Liability: A Contentious Idea

- Real Estate Insights and Practical Advice

- Kiyosaki's Educational Offerings: A Closer Look

- Addressing the Criticisms and Controversies

- Is Robert Kiyosaki's Advice Still Relevant Today?

- Frequently Asked Questions About Robert Kiyosaki

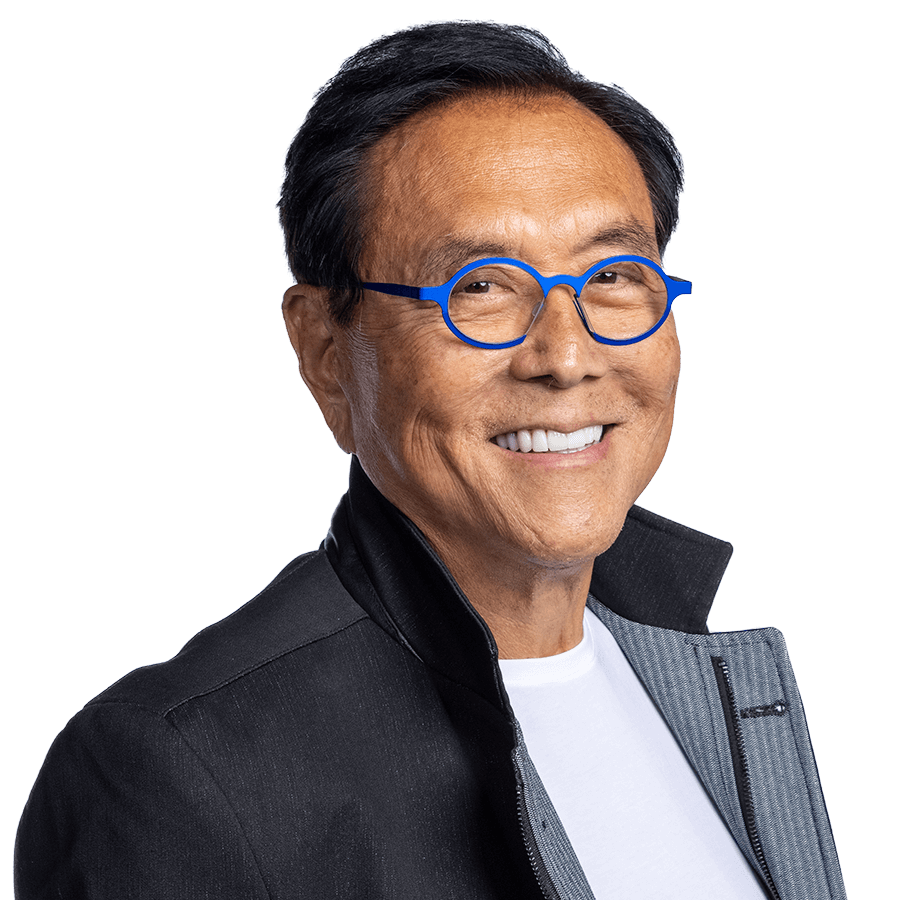

Robert Kiyosaki: Who Is He?

Robert Kiyosaki is an American businessman, investor, and author, best known for his Rich Dad Poor Dad series of personal finance books. His teachings often challenge conventional wisdom about money and investing, encouraging people to pursue financial education outside of traditional schooling. He speaks about financial independence through investing, real estate, and owning businesses, as well as building assets, and he really does stress the importance of financial literacy for everyone.

Personal Details and Bio Data

| Detail | Information |

|---|---|

| Full Name | Robert Toru Kiyosaki |

| Born | April 8, 1947 (Age 77 as of 2024) |

| Birthplace | Hilo, Hawaii, U.S. |

| Nationality | American |

| Occupation | Author, Investor, Businessman, Motivational Speaker |

| Best Known For | Rich Dad Poor Dad book series |

| Key Themes | Financial literacy, investing, real estate, entrepreneurship, assets vs. liabilities |

The Core of Kiyosaki's Philosophy: Assets Versus Liabilities

One of the most important lessons from Robert Kiyosaki, and a very central part of his teachings, is the idea of owning assets, not liabilities. He says that people who become financially free focus on acquiring things that put money into their pocket, rather than taking money out. This distinction is, in some respects, pretty simple, but it can be quite a powerful way to look at your personal finances. For example, a rental property that brings in income would be an asset, whereas a car that only costs you money for gas, insurance, and repairs would be a liability.

This concept is truly fundamental to his approach. He encourages people to shift their thinking from just earning a paycheck to building a portfolio of income-generating assets. It's a way of saying, "Don't just work for money; make your money work for you." This idea, you know, really resonated with me when I first read it, as it offers a different path to financial well-being than simply saving money in a bank account or relying on a pension. It really does make you consider what you own and what it actually does for your financial picture.

The House as a Liability: A Contentious Idea

Perhaps one of Robert Kiyosaki's most talked-about and, in a way, controversial pieces of advice is his claim that buying your own house is a liability. This particular idea often catches people off guard because, for many, owning a home is the very picture of the "American Dream" and a sign of financial stability. He says that buying your own house is a liability, since it often takes money out of your pocket through mortgage payments, property taxes, insurance, and maintenance. It's a cost center, not an income generator, at least in his view.

This perspective, while challenging to some, really does force you to think differently about your biggest purchase. He's not saying that you shouldn't own a home, but rather that you should be aware of its financial impact and perhaps prioritize acquiring income-producing assets first. It's a different way to frame the conversation around homeownership, and it certainly sparks a lot of discussion among his readers. For those of you who've read Rich Dad Poor Dad, I have a question: How did you feel about this particular piece of advice? It can be a bit jarring, can't it?

This is where his focus on cash flow becomes very apparent. If your house isn't putting money into your pocket, he argues, it's a drain. Now, of course, a house can appreciate in value, and it offers shelter and stability, but Kiyosaki tends to look at it strictly from a cash-flow perspective. This is, you know, a very specific lens to view things through, and it's one that often causes people to rethink what they thought they knew about personal finance. It's almost like he wants you to question everything you've been taught about money.

Real Estate Insights and Practical Advice

Robert Kiyosaki often talks about real estate as a key way to build wealth. In his book Rich Dad Poor Dad, he writes, "I began shopping at the bankruptcy attorney’s office or the courthouse steps." This line really illustrates his approach to finding good deals: looking in places where others might not think to look, or where properties are sold at a reduced price due to distress. For example, he mentions a $75,000 house bought in such a way, which suggests a focus on value and finding opportunities that aren't obvious to the general public. It's a very specific kind of hunting for properties, to be sure.

He always talks about all his units, and he speaks about building a portfolio of properties that generate cash flow. However, whenever you hear him talk, he sounds like he only speaks concepts. This can be a bit frustrating for someone looking for concrete, step-by-step instructions. You know, it's like he gives you the big picture, but the smaller details of how to actually do it are sometimes left out. At least you can go and see Donald Trump's buildings, which are very real and tangible. Kiyosaki's examples, by contrast, can feel a bit abstract at times, which might leave some people wanting more specific guidance on how to apply his ideas to their own situations.

This conceptual approach can be a double-edged sword. On one hand, it inspires big thinking and encourages people to look beyond traditional paths. On the other hand, it can leave aspiring investors wondering how to translate those broad ideas into actual transactions. There are many theories as to what is going to happen in the American economy, and Kiyosaki's ideas often play into those discussions, suggesting ways to protect and grow wealth regardless of economic shifts. But, you know, getting from the theory to the practice is where many people, myself included, sometimes feel a little lost without more detailed examples or specific instructions.

Kiyosaki's Educational Offerings: A Closer Look

Beyond his books, Robert Kiyosaki also offers various seminars and courses, which are often promoted as ways to gain more in-depth knowledge and practical skills. I attended a 1-hour seminar for Robert Kiyosaki's Cashflow Blueprint, and it was certainly an interesting experience. These seminars often lead to offers for more extensive, paid programs. For instance, they are asking $700 for a 3-day course called Legacy Education, and the Cashflow Blueprint course is 5 payments of $99. I am a little uneasy spending that kind of money, and I know others feel the same way.

The cost of these courses can be a significant hurdle for many people, and it raises questions about the value offered versus the price. Some people might wonder if the information provided in these paid programs is truly unique and worth the investment, especially when his core ideas are already available in his books. Have some of you taken these courses? Is there new, unique methods that we should know that aren’t discussed on bigger pockets, for example? It's a valid question, as people want to make sure they're getting real value for their money, not just a rehash of what's already widely available.

The aggressive nature of some of these sales tactics was a bit turning off to me today. It's one thing to offer valuable education, but another to push expensive programs with high-pressure sales. This can make people, you know, feel a little hesitant or even suspicious. While the initial inspiration from his books is strong, the transition to these higher-priced offerings can create a sense of discomfort for potential students. It's something to consider if you're thinking about going beyond his published works and into his more structured educational programs.

Addressing the Criticisms and Controversies

Robert Kiyosaki, like any prominent figure, has faced his share of criticism. One common point of discussion revolves around the conceptual nature of his advice, as I mentioned earlier. Critics sometimes say that while his ideas are inspiring, they lack concrete, actionable steps that everyday people can easily follow. It's almost like he gives you the destination but not a clear map, which can be frustrating for those looking for direct guidance. This is why some people compare his approach to someone like Donald Trump, whose real estate holdings are, you know, very visible and tangible.

Another area of concern for some people is the aggressive marketing of his seminars and courses. The feeling of being pushed to spend hundreds or even thousands of dollars on educational programs can make people wary, especially if they're already feeling a little uneasy about their finances. This approach can, in a way, detract from the valuable core messages in his books. It makes people question whether the primary goal is to educate or to sell, and that's a very fair question to ask, really.

There have also been questions about the specifics of his own financial background and the accuracy of some stories in his books. While he maintains that the "Rich Dad" character is a composite, some critics have pointed out that the lack of verifiable details can make it harder to fully trust the advice. However, many followers argue that the principles themselves are what matter, regardless of the exact biographical details. It's a debate that continues, and it's something people consider when evaluating his overall credibility.

Is Robert Kiyosaki's Advice Still Relevant Today?

Despite the criticisms and the passage of time, many of Robert Kiyosaki's core principles remain highly relevant, particularly in today's economic climate. The emphasis on financial literacy, understanding assets versus liabilities, and seeking alternative paths to wealth building are timeless concepts. With ongoing discussions about inflation, economic shifts, and the future of work, his encouragement to take control of your financial education feels, you know, more important than ever. His ideas certainly prompt people to think differently about their money.

His advice to look for opportunities in less conventional places, like the bankruptcy attorney's office, still holds true for those willing to put in the effort. The idea of acquiring income-producing assets is, in some respects, a fundamental principle of wealth creation that transcends specific market conditions. While the methods might change, the underlying concept of making money work for you, rather than just working for money, is a powerful and enduring lesson. It's a message that continues to resonate with people seeking greater financial freedom.

Ultimately, Robert Kiyosaki's work serves as a powerful catalyst for financial education. While it's important to approach his advice with a critical mind and to do your own research, the inspiration he provides for thinking differently about money is undeniable. Many people, myself included, found his initial insights to be truly transformative, even if some of the later offerings felt a little too aggressive. His influence on the personal finance world is, in a way, massive, and his ideas continue to spark important conversations about how we manage our money and build our futures. To learn more about financial independence on our site, you can also check out this page for more investing strategies.

Frequently Asked Questions About Robert Kiyosaki

Is Robert Kiyosaki a millionaire?

Yes, Robert Kiyosaki is widely considered to be a millionaire, and his wealth primarily comes from his successful books, speaking engagements, and various business ventures, including real estate and educational programs. He has built a significant financial standing through the application of the principles he teaches.

What are Robert Kiyosaki's main teachings?

Robert Kiyosaki's main teachings center on financial literacy, the importance of distinguishing between assets and liabilities, and the idea of making money work for you. He advocates for investing in income-producing assets like real estate and businesses, rather than relying solely on a traditional job or savings. He also emphasizes the role of financial education outside of formal schooling.

Is Rich Dad Poor Dad a true story?

Robert Kiyosaki has stated that the "Rich Dad" and "Poor Dad" characters in his book are composite figures, meaning they are based on real people and experiences but are not literal, single individuals. The lessons and principles presented in the book are, however, based on his observations and teachings from these influential figures in his life. So, the story is more of a parable to illustrate his financial concepts.

Robert Kiyosaki: A Successful Entrepreneur and Financial Educator | by

Robert Kiyosaki’s Shocking Prediction: The Biggest Stock Market Crash

¿Quién Es Robert Kiyosaki Y Por Qué Debes Saber Sobre Él? | CoinGape