Prospa Ochimana: Discovering The Future Of Small Business Funding

Detail Author:

- Name : Joey Botsford

- Username : mwillms

- Email : metz.lloyd@gmail.com

- Birthdate : 1988-08-26

- Address : 195 Georgiana Junction Suite 134 West Anjaliberg, NH 51660

- Phone : 878-801-7054

- Company : Gorczany-Kirlin

- Job : Production Planning

- Bio : Tempora earum iusto dignissimos laborum ad nesciunt et. Nostrum dolor quis tempora eos quos. Quos rerum officia nesciunt omnis excepturi. Vel quas quia et vel.

Socials

tiktok:

- url : https://tiktok.com/@jbogan

- username : jbogan

- bio : Ullam dolores qui reprehenderit eius qui sunt magnam.

- followers : 5405

- following : 1870

linkedin:

- url : https://linkedin.com/in/juanita6677

- username : juanita6677

- bio : Architecto et nihil saepe qui dolor eveniet.

- followers : 2483

- following : 1441

instagram:

- url : https://instagram.com/bogan1990

- username : bogan1990

- bio : Corrupti suscipit in perferendis asperiores. Sed debitis nesciunt nam a ut eveniet quaerat.

- followers : 4183

- following : 57

facebook:

- url : https://facebook.com/juanitabogan

- username : juanitabogan

- bio : Quae laudantium minima magni sunt.

- followers : 3634

- following : 2439

Are you curious about Prospa Ochimana and what it could mean for your small business? For many business owners, finding the right financial support feels like a big challenge. So, it's almost as if knowing where to turn for quick, fair funding is a top priority for people building their dreams. This article aims to shed some light on what Prospa offers, making things a bit clearer for you.

When you're searching for "prospa ochimana," you might be looking for a name connected to a company that helps small businesses thrive. This piece will walk you through the ways Prospa has been helping Australian and New Zealand businesses for over a decade. We'll look at their approach to business finance, which is rather focused on keeping things simple and easy for you.

It’s really about getting you the money you need without a lot of fuss. Prospa has a way of doing things that feels different, a bit more human, and certainly less stressful than what you might typically expect from a financial service. We will cover everything from their loan options to their online business accounts, so you know just what's available.

Table of Contents

- Prospa: A Pioneer in Business Finance

- Getting Started with Prospa

- Understanding Prospa Loans

- The Prospa Online Business Account

- Why Businesses Choose Prospa

- Eligibility and Fast Funding

- Frequently Asked Questions About Prospa

Prospa: A Pioneer in Business Finance

Prospa has been around for more than ten years, gathering a lot of knowledge about what small businesses truly need. They see themselves as pioneers in making financial management simple, stress-free, and seamless, which is quite a claim to make. They have put their understanding of small businesses to work over this time, helping many owners.

Their experience means they have a pretty good idea of the challenges business owners face when looking for money to grow or just keep things running. This background helps them build services that truly fit the bill. You know, they are all about making things easier for the people who are out there building businesses, which is a big deal.

The company's focus is on clear communication. With Prospa, you’ll have a very clear understanding of what’s expected from you. This includes how much your weekly repayments will be, and also when they’ll be due. This transparency is a key part of their way of doing things, helping you stay on top of your finances, which is rather helpful.

Getting Started with Prospa

If you're thinking about getting some financial help for your business, reaching out to Prospa is pretty straightforward. You can simply call them at 1300 882 867 to get started on your business journey. This direct line means you can talk to someone right away about what you might need, which is quite convenient.

For those who prefer doing things online, applying for a small business loan with Prospa is an option. You can apply online, which means you can do it from anywhere, at any time that suits you. This online application process is designed to be quick, saving you precious time, you know, time that you could be spending on your business.

They aim to make the first steps as easy as possible. This approach is really about removing the usual hurdles you might find with traditional lenders. It’s a way of saying, "We get that your time is valuable," and they show it by making the start of the process so simple. So, getting going with them is, in some respects, less of a chore.

Understanding Prospa Loans

Prospa offers small businesses fast business loans. They know that sometimes, you just can't wait weeks for a decision. Their goal is to provide funding solutions that truly match your business needs, offering amounts up to $300,000. This range means they can help a lot of different businesses, which is pretty good.

For small business loans or business lines of credit up to $150,000, no asset security is required upfront to access the funds. This is a big plus for many business owners, as it means you don't have to put your personal assets on the line right away. It takes a lot of pressure off, you know, when you're trying to grow your company.

You can also get fast approval with Prospa, and they offer flexible terms. This flexibility means they try to work with you to find repayment plans that fit your cash flow. It’s not a one-size-fits-all approach, which is rather refreshing. They understand that every business is a bit different, and their terms reflect that.

They can even get you funded within two business days once your application is approved. That's a pretty quick turnaround when you think about it, especially if you have an urgent need for money for your business. It means you can get back to doing what you do best, without long waits, which is quite helpful.

How Prospa Determines Creditworthiness

Prospa looks at the overall health of a business to determine creditworthiness. This is different from some traditional lenders who might focus heavily on personal credit scores or collateral. They consider the bigger picture of your business's operations and financial flow, which is, you know, a more holistic view.

This approach means that even if you don't have a long history of traditional borrowing, your business might still be eligible for funding. They're interested in how your business is actually doing, its ability to generate revenue, and its general stability. It’s a way of seeing the potential, you could say, rather than just past numbers.

It's about making sure the loan makes sense for your business's current situation and its future prospects. They want to ensure that the funding will genuinely help your business, not become a burden. So, they try to make a decision that's fair and supportive of your business's ongoing success.

The Prospa Online Business Account

Beyond loans, Prospa also offers an online business account. This account comes with no monthly fees, which is a pretty sweet deal for small businesses looking to save on costs. There are also no minimum balance requirements, meaning you don't have to worry about keeping a certain amount of money in the account just to avoid fees.

They’ve designed the Prospa business account just for small businesses, with these benefits in mind. It's built to be simple and useful for your day-to-day operations. You can open an account in minutes, which is really fast, and then start depositing funds, sending, and receiving payments right away. It's all about making banking easier.

This online account aims to simplify your financial management. It's a tool that helps you keep your business finances organized and accessible, which is rather important for any small operation. You know, having everything in one place can really save you a lot of headaches, making it less of a chore.

Why Businesses Choose Prospa

Businesses often choose Prospa because of the speed and simplicity they offer. When you need money for your business, waiting around is often not an option. Prospa's promise of fast approval and funding within two business days really appeals to owners who have immediate needs, which is a common situation for many.

Their focus on understanding small business needs, built over more than a decade, also makes them a preferred choice. They don't just offer money; they offer solutions that are shaped by real-world experience. This means they speak your language, so to speak, and understand the practicalities of running a small company.

The fact that they don't require upfront security for loans up to $150,000 is a significant draw. This policy helps reduce the risk for business owners, making it less scary to seek funding. It shows a certain level of trust in the business itself, rather than just in assets, which is a refreshing approach for many.

Their customer support is also readily available. For those in Australia, you can reach them at 1300 882 867 or send an email to help@prospa.com. For New Zealand businesses, the number is 0800 005 797, or you can email help@prospa.co.nz. Having these direct lines makes it easy to get help when you need it, which is rather comforting.

Eligibility and Fast Funding

One of the best things about Prospa is how quickly you can see if your business could be eligible for a loan. You can check your eligibility in under a few minutes online. This quick check means you don't waste time on a lengthy application only to find out you don't qualify, which is, you know, a real time-saver.

The process is designed to be as efficient as possible, letting you know your options almost right away. This speed is a big part of what makes Prospa stand out for many business owners. They understand that time is money, especially for small businesses, so they try to make every step count, which is quite considerate.

Once approved, getting your money is also very fast. As mentioned, funds can be deposited within two business days. This quick access to capital means you can seize opportunities, cover unexpected costs, or invest in growth without significant delays. It's really about giving you the financial agility your business needs, so you know, it helps a lot.

For more general information on managing small business finances, you might find resources on government business websites helpful. Learn more about on our site, and link to this page for specific details on business funding solutions.

Frequently Asked Questions About Prospa

Q1: What kind of businesses does Prospa help?

Prospa focuses on helping small businesses across various sectors. They have built their services with the specific needs of smaller operations in mind. Their understanding comes from over a decade of working with such businesses, so they know the common challenges and opportunities. It's not just about the size of the business, but its overall health and potential, you know, that really matters to them.

Q2: How quickly can I get funds from Prospa?

Prospa is known for its speed in getting funds to businesses. After you apply and get approved, you can typically expect to receive the money within two business days. This quick turnaround is a key feature, allowing businesses to access needed capital without long waits, which is rather important for many urgent situations.

Q3: Do I need to provide security for a Prospa loan?

For small business loans or business lines of credit up to $150,000, Prospa does not require upfront asset security. This means you generally don't have to put up your personal or business assets as collateral to get these funds. They consider the health of your business to determine creditworthiness instead, which is a bit different from traditional ways.

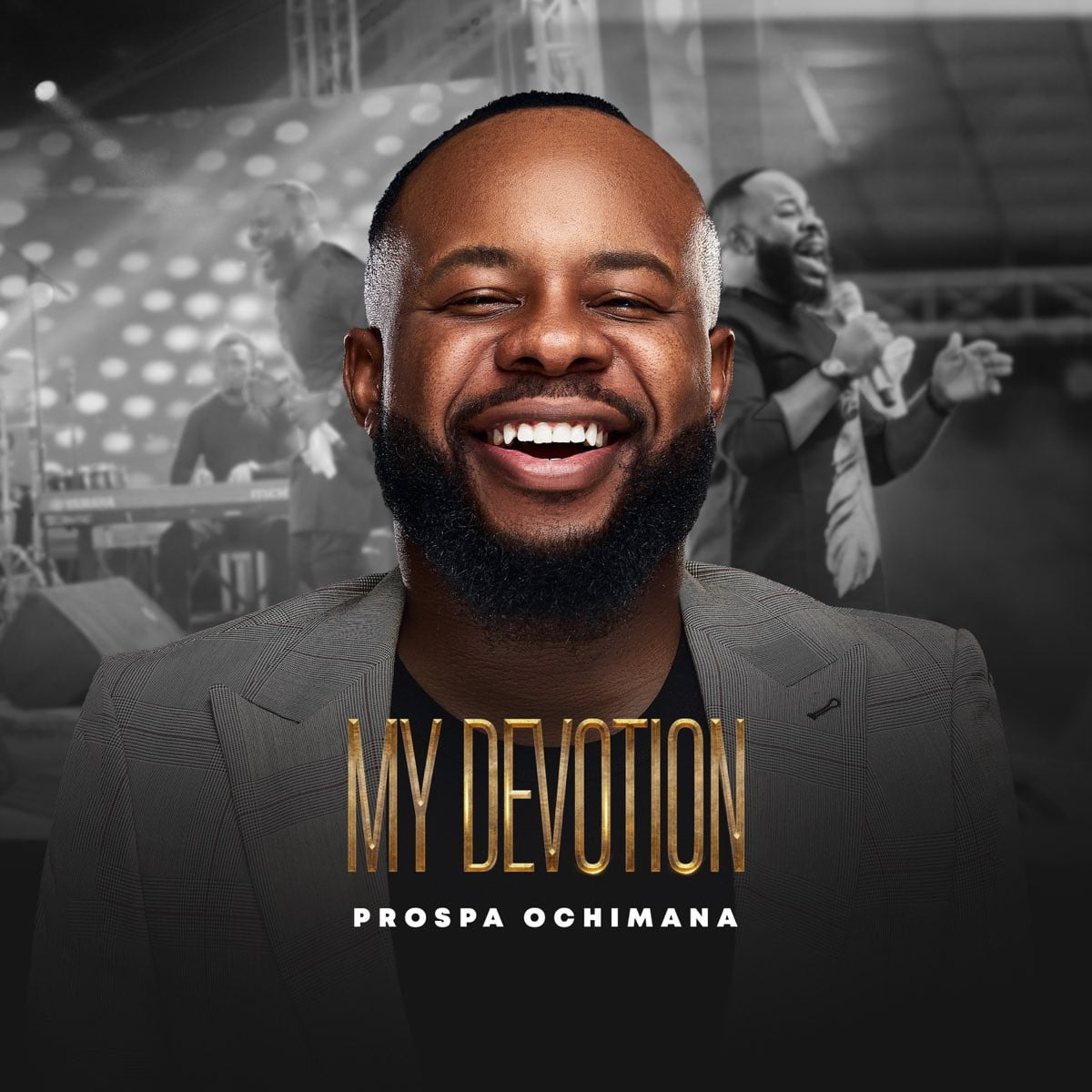

Prospa Ochimana - Out Of My Belly... (Lyric Video) ( 914 X 1920

Prospa Ochimana – Chioma Song - Premium9ja

Prospa Ochimana - My Devotion (Mp3 Download, Lyrics)