After All That: The Relief Of Flexible Payments

Detail Author:

- Name : Cathrine Wiegand

- Username : karen15

- Email : lhudson@feest.com

- Birthdate : 1983-06-02

- Address : 2856 Daniel Fork Apt. 365 Alexastad, AK 56958

- Phone : +1 (318) 233-2599

- Company : Hartmann, Brekke and Daugherty

- Job : Radiologic Technologist and Technician

- Bio : Eveniet dolores debitis voluptas atque sunt et. Earum a est ea eligendi dolorem suscipit. Saepe facilis et veniam libero.

Socials

twitter:

- url : https://twitter.com/laila.white

- username : laila.white

- bio : Sunt atque debitis cum id consectetur. Ut saepe eveniet dolores illum et nulla.

- followers : 542

- following : 1407

facebook:

- url : https://facebook.com/whitel

- username : whitel

- bio : Omnis aut vitae quasi tempora doloremque est omnis.

- followers : 5945

- following : 305

linkedin:

- url : https://linkedin.com/in/lwhite

- username : lwhite

- bio : Cupiditate atque ab sed eos est odit iure qui.

- followers : 5791

- following : 972

Sometimes, life just feels like a long list of things to do, doesn't it? You work hard, you save up, and then, you know, there are still those moments when you really want something, or maybe even need it, but the timing just isn't quite right for a big upfront payment. That feeling, after all that effort, when you finally find a way to make things work smoothly? It's pretty great, actually. We're talking about that moment of calm, that sense of accomplishment, when a solution appears right when you need it most, allowing you to move forward without a big financial squeeze right then.

For many, that sense of relief comes from smart ways to manage money, especially when it comes to buying things you want or need. Think about it: you've been looking for that perfect item, perhaps for your home, or maybe a new gadget, and you've thought about how to fit it into your budget. Then, you discover a payment method that simply makes sense, allowing you to get what you want without waiting. This approach helps so many people, giving them a bit more breathing room in their everyday spending plans, and that, is that, truly makes a difference.

This idea of making things easier, especially after you've put in the thought and effort, is becoming more and more popular. It’s about more than just buying things; it’s about having options that fit your life, giving you a chance to spread out costs and manage your cash flow better. So, in some respects, let's explore what it means to feel that calm "after all that" consideration, and how modern payment solutions are helping people achieve just that, nearly every single day.

Table of Contents

- The Meaning of After All That in Daily Life

- Understanding the Afterpay Experience

- Feeling Good About Your Purchases

- Frequently Asked Questions About Flexible Payments

- Your Next Steps After All That Consideration

The Meaning of After All That in Daily Life

Life, you know, can be a bit of a marathon. We put in so much effort, day in and day out, whether it's at work, with family, or just managing our personal finances. The phrase "after all that" really captures a moment of culmination, doesn't it? It's that point where you look back at the journey, the decisions, the planning, and then you finally get to the payoff. For many people, this feeling connects directly to how they manage their money and make purchases, especially when they find a method that makes things easier, like, pretty much immediately.

Imagine you've been saving up for something important, or perhaps you've just had an unexpected expense pop up. The thought of shelling out a large sum all at once can be a bit daunting, can't it? That's where the "after all that" feeling comes in when you discover a way to spread out the cost. It’s about reducing that immediate financial pressure, allowing you to breathe a little easier. This kind of relief, honestly, is what many people are looking for in their daily lives, as a matter of fact.

This concept of finding ease after effort isn't new, but the tools we have to achieve it certainly are. We're seeing a shift in how people approach spending, moving towards solutions that offer more flexibility and control. It's about empowering individuals to make purchases they need or want without compromising their immediate financial stability, which, you know, is a really good thing for peace of mind. This way, after all that thinking and planning, the actual purchase feels like a reward, not a burden.

Why Flexible Payments Matter

Flexible payments are, in a way, like having a helpful friend for your wallet. They give you the ability to manage your money in a way that suits your current situation, rather than being forced into a rigid payment schedule. For instance, if you're looking at a new appliance, or maybe some clothes for the kids, having the option to pay over time can make a big difference to your monthly budget. It’s about making sure your money works for you, giving you choices, and that, is that, quite important.

The traditional way of paying for everything upfront, or relying solely on credit cards, doesn't always fit everyone's financial picture. Flexible payment options, however, provide an alternative that can help avoid debt or simply make larger purchases more manageable. They offer a sense of freedom, allowing you to access items when you need them, without waiting until you have the full amount saved up. So, you know, it's about practical financial planning for the everyday person, basically.

This approach is particularly helpful for those who prefer to keep their cash flow steady. It means you can get what you need today, and then comfortably pay for it in smaller, predictable chunks over a few weeks. This can help prevent the stress that often comes with big expenses, making the whole shopping experience much more pleasant, and, you know, less of a headache. It's about making your money work smarter, after all that hard work you put into earning it.

The Rise of Buy Now, Pay Later

You've probably noticed it more and more lately: the option to "buy now, pay later" showing up at checkout. This trend has really taken off, and for good reason. It speaks to that desire for immediate gratification combined with smart financial planning. People want to get their items right away, but they also want to manage their money responsibly, and this kind of payment method helps them do just that. It's a pretty compelling combination, honestly.

One of the leaders in this space, as you might have heard, is Afterpay. It’s a prime example of how these services work, offering a straightforward way to split purchases. This model has resonated with a lot of shoppers because it’s transparent, typically without interest fees if payments are made on time, and it’s very easy to use. This kind of payment method has become a go-to for many, especially those who like to keep a close eye on their spending, you know.

The growth of "buy now, pay later" reflects a broader shift in consumer behavior. People are looking for more control and less financial pressure when they shop. They want convenience, but also a clear understanding of what they're committing to. This is where services like Afterpay shine, providing a clear path to owning something you want, after all that consideration about how to pay for it. It's a simple idea, really, but it makes a big impact.

Understanding the Afterpay Experience

So, you might be wondering, how exactly does Afterpay fit into this picture of finding ease after all that financial thought? Well, it’s designed to be pretty simple and user-friendly, from the moment you decide to use it. It aims to take away the stress of large upfront costs, allowing you to enjoy your purchases sooner. It's about giving you that feeling of "finally!" when you complete a transaction, you know, without breaking the bank right away.

For many, the first step is often to Log in to your afterpay account. It's where you manage your payments, see your history, and generally keep tabs on everything. This easy access means you're always in control of your spending, which, you know, is a really good feeling. It’s about transparency and giving you the tools to manage your own financial situation effectively, after all that initial setup, which is pretty quick, by the way.

The core promise of Afterpay is quite appealing: it

Afterpay allows you to buy now and pay in four instalments over 6 weeks

. This structure is what makes it so popular, as it breaks down a larger sum into smaller, more manageable chunks. It’s a clear plan, allowing you to budget for each payment without feeling overwhelmed. This kind of flexibility is what many people are looking for these days, especially when making bigger purchases, and it’s very helpful.How Afterpay Works for You

One of the best things about Afterpay is how widely accepted it is. It's not just for a few obscure stores;

Afterpay is fully integrated with all your favorite stores

, or at least, many of the big ones you already love to shop at. This means you don't have to change your shopping habits much to use it, which, you know, is a huge convenience. It fits right into your existing routine, making the process seamless, and that, is that, a big plus for busy people.The process itself is incredibly straightforward. You

Shop as usual, then choose afterpay as your payment method at checkout

. That's really all there is to it. There are no complicated forms or lengthy approval processes once you're set up. It’s designed to be quick and easy, so you can get on with your day and enjoy your purchase. This simplicity is a key part of the "after all that" feeling of relief, honestly.If you're new to it, the experience starts with a friendly greeting:

Welcome to afterpay 👋 let's finish setting you up

. This welcoming tone sets the stage for a user-friendly experience, guiding you through the initial steps so you can start using the service right away. It's about making the start of your journey as smooth as possible, so after all that thinking about how to pay, the actual setup is a breeze, virtually.Shopping with Afterpay Made Simple

The convenience extends beyond just online shopping, too. In many places, you can

Simply tap to pay and split your purchase into 4

right there in the store. This brings the same flexibility of online payments to your in-person shopping trips, which, you know, is incredibly handy. It means you don't have to carry a bunch of cash or rely solely on your credit card for every purchase, offering a lot more freedom, apparently.For those who prefer to shop from the comfort of their home,

Afterpay is offered online by many leading retailers across the u.s

. This widespread availability means you're likely to find it as an option at your favorite online shops, making it easier to manage your budget for a wide range of items. It’s about accessibility and ensuring that this helpful payment method is there when you need it, after all that searching for the right product.If you're ever curious about where you can use it, or want to explore new places to shop, Afterpay makes it easy to find out. You can

For a full list of retailers, visit our shop dire.

(likely meaning 'directory'). This resource is a great way to discover new stores that offer flexible payments, expanding your shopping horizons and giving you even more options. It’s about providing clear information, so you’re never left wondering, which is pretty helpful, really.Afterpay for Businesses and the Future

It's worth noting that the world of flexible payments is always changing. For instance,

Afterpay us has a new name, cash app afterpay

. This kind of change shows how these services are evolving and integrating with broader financial platforms. It means that what you know about Afterpay might expand to include other financial tools, making your money management even more connected and convenient, which, you know, is a pretty exciting development.For businesses, these changes are important too. They need to

Find out what that means for merchants and how to update your website.

Staying current ensures they can continue to offer the best payment options to their customers, which ultimately benefits everyone. It’s about keeping up with the pace of technology and consumer demand, making sure the shopping experience remains smooth and attractive, after all that work they put into their online stores.The overall aim of these services, from a user perspective, is to simplify things. If you ever have a question or need assistance, the goal is for you to easily find help. The idea is always to be able to ask,

What can we help with today

? This focus on support means that after all that shopping and managing, if something comes up, there's a clear path to getting it sorted out. It’s about providing a safety net and clear communication, which is incredibly reassuring, basically.Sometimes, information isn't always as clear as we'd like it to be. You might encounter a situation where

We would like to show you a description here but the site won’t allow us.

This can be frustrating, but it highlights the importance of transparent and accessible information, which Afterpay generally strives for. It’s about making sure that after all that searching for details, you can actually find what you need, making the whole experience less confusing and more straightforward, typically.Feeling Good About Your Purchases

The true benefit of flexible payment options, like Afterpay, isn't just about the mechanics of splitting payments. It’s about the feeling you get after all that deliberation and budgeting, when you can finally make a purchase without feeling strained. It’s about the peace of mind that comes from knowing you can manage your finances effectively while still getting the things you want or need. This sense of control, you know, is very empowering.

Think about it: you find that perfect item, you see the price, and instead of a sigh, you feel a sense of calm because you know there’s a way to make it fit comfortably into your budget. This allows you to enjoy your purchase from the moment you click "buy" or tap to pay, rather than worrying about the immediate impact on your bank account. It transforms shopping from a potential source of stress into a genuinely positive experience, which, honestly, is a great outcome.

Ultimately, these payment methods are designed to support your lifestyle, offering a practical solution for modern spending. They represent a step forward in making financial choices more accessible and less intimidating for everyone. So, after all that planning, researching, and thinking, you can feel genuinely good about your purchases, knowing you’ve made a smart choice for your wallet and your peace of mind. You can Learn more about flexible payment solutions on our site, too it's almost a whole new way to think about shopping.

Frequently Asked Questions About Flexible Payments

People often have questions when they first hear about services like Afterpay. It’s natural to want to understand how they work and if they're a good fit for your situation. Here are a few common questions that come up, helping to clarify things after all that initial curiosity.

1. How is Afterpay different from a credit card?

Well, a credit card typically lets you borrow money up to a certain limit and then charges interest on the balance you carry over each month. Afterpay, on the other hand, lets you split your purchase into four equal payments, usually due every two weeks, over six weeks. The key difference is that Afterpay generally doesn't charge interest if you make your payments on time. It's more about managing your cash flow for a specific purchase, rather than ongoing borrowing, which, you know, is a pretty big distinction.

2. Are there any hidden fees with Afterpay?

Generally speaking, Afterpay aims to be quite transparent. If you make your payments on time, there are typically no extra fees. However, if you miss a payment, there might be a late fee, so it's really important to keep track of your payment schedule. The idea is to be clear about everything upfront, so after all that shopping, you won't be surprised by unexpected charges, which is something people really appreciate, apparently.

3. Can I use Afterpay for any purchase?

While Afterpay is widely accepted, it's not available for every single purchase or at every store. It's offered by many leading retailers, both online and in person, but it's always a good idea to check if a specific store offers it at checkout. Also, there might be minimum or maximum purchase amounts for using Afterpay. So, after all that excitement about a potential purchase, just double-check the payment options before you get too far, just a little bit of planning helps.

Your Next Steps After All That Consideration

So, after all that talk about flexible payments and how they can make your life a bit easier, what's your next move? If the idea of managing your purchases in smaller, more comfortable installments sounds appealing, then exploring options like Afterpay could be a really good idea for you. It's about finding financial tools that genuinely support your lifestyle and help you achieve that feeling of ease and control. It's not about spending more, but spending smarter, you know.

Consider looking into how Afterpay works with your favorite stores. Many people find it incredibly convenient once they start using it, and it can really change the way you approach larger purchases. It’s about empowering yourself with choices, so you can get what you need when you need it, without the immediate financial strain. That, is that, a pretty liberating feeling, actually.

Ultimately, the goal is to make your financial life less complicated and more manageable. Flexible payment options are just one way to achieve that, helping you feel more in control and less stressed about your spending. So, after all that thought, why not give it a try and see how it can simplify things for you? It could be just the solution you've been looking for, honestly, to make your money work better for you, and your peace of mind.

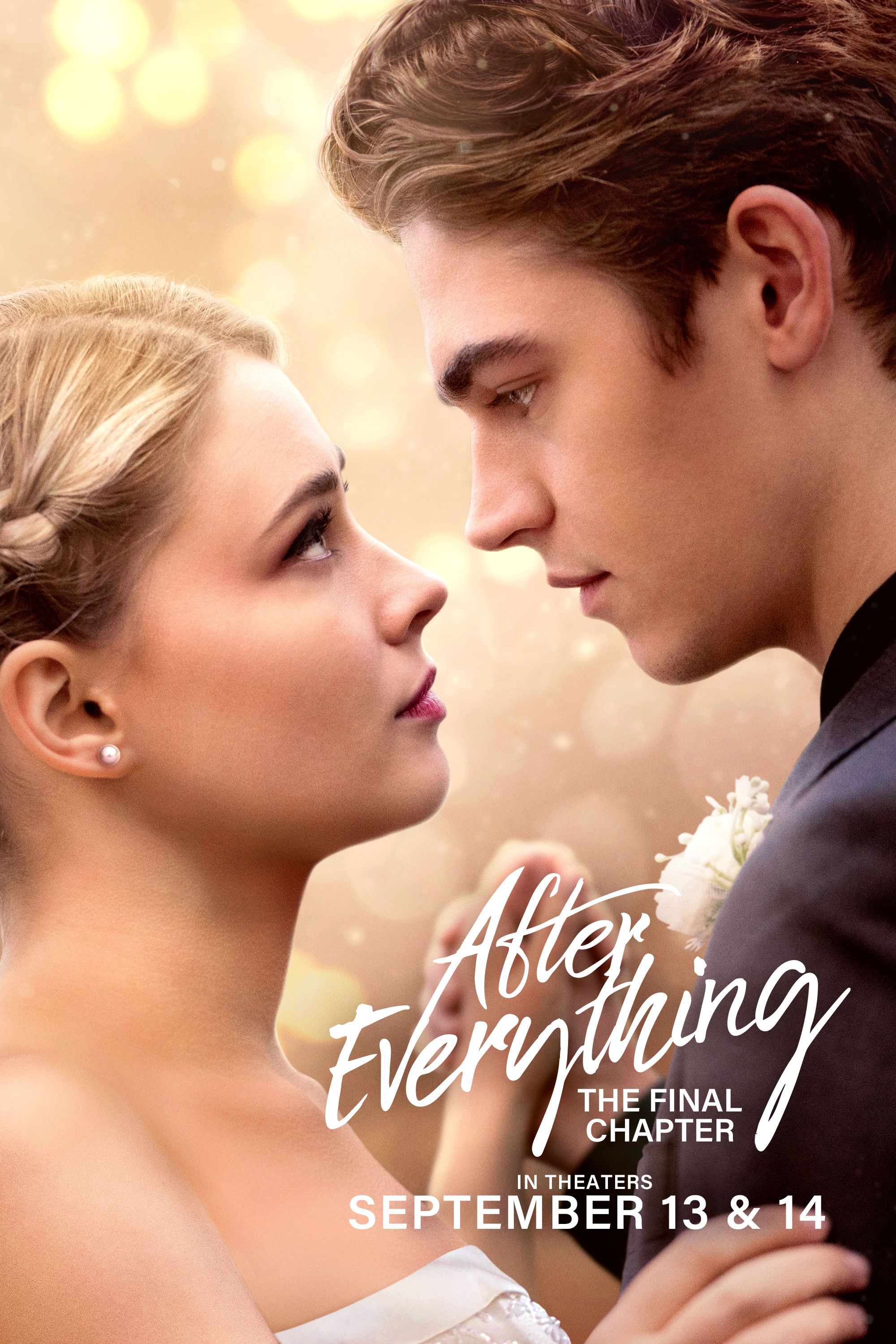

'After' Movie Photos - See Every Steamy Still from the Film!: Photo

After Movies in Order: How to Watch Chronologically and by Release Date

After. Film (2019). Recensione. Regia di Jenny Gage. Con Josephine