What's The W8 Meaning Anyway? Your Guide To This Important Tax Form

Detail Author:

- Name : Mrs. Ilene Deckow Jr.

- Username : oschulist

- Email : genevieve.kub@yahoo.com

- Birthdate : 2006-07-29

- Address : 2169 Calista Springs West Hayden, GA 21600

- Phone : (551) 951-4484

- Company : Zulauf-Thiel

- Job : Retail Salesperson

- Bio : Natus explicabo odit quasi ipsa velit. Nihil rerum voluptatum quia atque. Mollitia est rerum at iste qui consequatur.

Socials

instagram:

- url : https://instagram.com/vhartmann

- username : vhartmann

- bio : Facilis aliquam minima ex cum. Doloribus et et minus aut. Dolore tenetur numquam laboriosam quia.

- followers : 6995

- following : 2546

linkedin:

- url : https://linkedin.com/in/vincenzohartmann

- username : vincenzohartmann

- bio : Enim qui et aliquam totam recusandae.

- followers : 5424

- following : 1780

Have you ever wondered what the `w8 meaning` truly is, especially when you are an individual or a business receiving income from the United States? It's a question many people outside the U.S. often ask, and honestly, it can seem a little confusing at first glance. This particular form, known more commonly as the W-8BEN, plays a really big part in how your U.S.-sourced earnings are handled for tax purposes. You see, it's not just some random paper; it's a way for you to tell the U.S. tax authorities about your status, which can help prevent too much money from being held back from your payments.

For anyone living outside the U.S. but earning money from sources within it, understanding the `w8 meaning` is pretty important. This form helps to make sure that the right amount of tax is taken out, or "withheld," from your income. It's basically your way of saying, "Hey, I'm not a U.S. person for tax purposes," and it often allows you to claim a reduced rate of withholding, or even an exemption, based on tax treaties between your home country and the U.S. So, it's about making sure you pay what's fair and not more.

So, why does this matter so much? Well, without this form, businesses and brokers in the U.S. who are paying you might have to hold back a much larger chunk of your money for taxes, simply because they don't know your foreign status. That's why knowing the `w8 meaning` and how to handle this document can save you a lot of hassle and, frankly, some money down the line. It's a crucial step for smooth financial dealings across borders, and it's something you really want to get right from the start, you know?

Table of Contents

- What is the W8 Meaning at Its Core?

- Who Exactly Needs This Form?

- Why This Form Matters So Much

- Finding and Handling Your W-8BEN Form

- Tips for Getting Your W-8BEN Right

- Common Questions About the W-8BEN Form

- Keeping Up with Your W-8BEN

What is the W8 Meaning at Its Core?

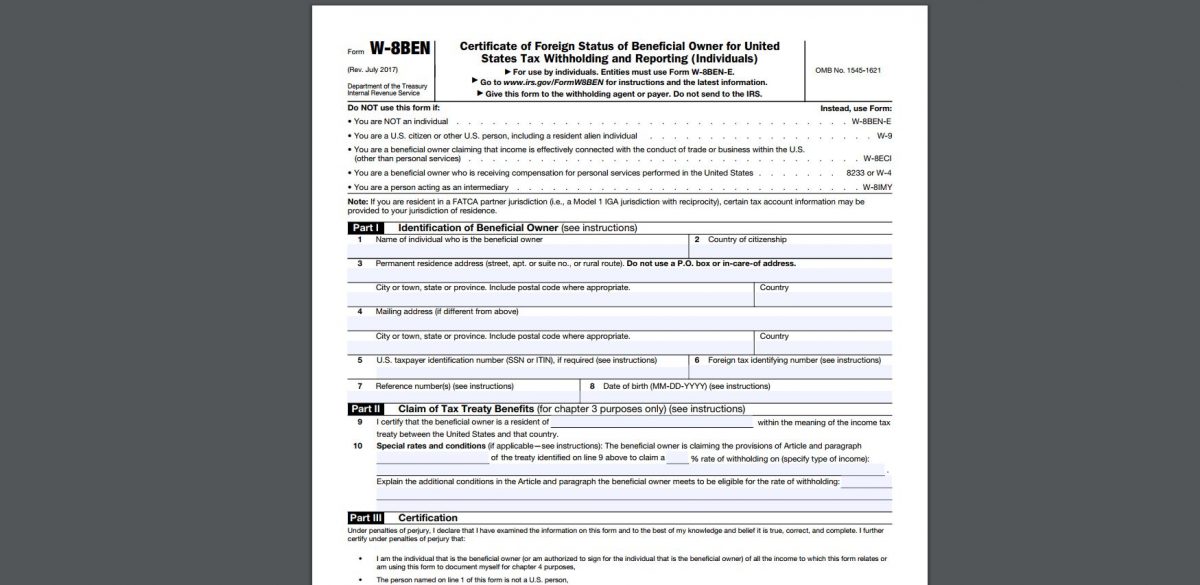

When we talk about the `w8 meaning`, we're mostly talking about a specific set of forms the U.S. Internal Revenue Service, or IRS, uses. The most common one people encounter is the Form W-8BEN, which stands for "Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding and Reporting (Individuals)." It's a pretty long name, isn't it? But basically, it's a document for individuals who are not U.S. citizens or residents but get income from U.S. sources.

This form lets you confirm your status as a foreign person. It also helps you claim any benefits you might be able to get from a tax treaty between your country and the United States. For example, some treaties say that certain types of income, like royalties or interest, should have a lower tax rate or even no tax taken out at all. This form is how you tell the U.S. payer about that, so they don't hold back too much money, you know?

There are actually several versions of the W-8 form, each for different situations. While W-8BEN is for individuals, there's also W-8BEN-E for foreign entities, W-8ECI for income effectively connected with a U.S. trade or business, and others. So, when someone asks about the `w8 meaning`, it's usually referring to the W-8BEN, as that's the one most individuals will need to deal with, frankly.

Who Exactly Needs This Form?

So, who really needs to fill out this W-8BEN form? Well, if you're an individual who isn't a U.S. citizen, a U.S. resident alien, or a U.S. person for tax purposes, and you're earning money from the U.S., then you likely need it. This could be income from investments, like dividends or interest, or perhaps payments for services you provided while living outside the U.S. It's all about your tax residency, which is sometimes different from where you live, you know?

Think about it this way: if you're a freelancer in Canada providing services to a U.S. company, or an investor in the UK receiving dividends from U.S. stocks, you're probably going to be asked for a W-8BEN. The U.S. payer needs this form to make sure they're following U.S. tax rules when they send money to someone who isn't a U.S. taxpayer. It's basically a declaration of your foreign status, which is pretty essential for them.

Businesses or brokers in the U.S., like mutual funds, really rely on this form. It helps them meet their obligations to the IRS and ensures they withhold the correct amount of tax from payments to non-U.S. individuals. Without it, they might have to assume you are a U.S. person and apply a much higher withholding rate, which would mean less money for you. So, in some respects, it protects both you and the payer, you see.

Why This Form Matters So Much

The core `w8 meaning` really boils down to tax compliance and making sure you don't pay more tax than you need to. Its main purpose is to let brokers and mutual funds, or any other U.S. payer, know that you are a foreign person. This information is vital for them to ensure they are withholding the correct amount of U.S. tax from your income. Without it, they generally have to withhold at a much higher rate, typically 30%, on certain types of income.

Imagine receiving a payment from a U.S. company, and suddenly a large portion is missing because they held it back for taxes. That's what can happen if you don't provide a W-8BEN. By submitting the form, you're telling the payer your foreign status and, if applicable, claiming a reduced rate of withholding based on a tax treaty. This means more of your earned money stays with you, which is obviously a good thing, right?

It's also about avoiding common mistakes and ensuring compliance for the entities paying you. They need this form to fulfill their reporting duties to the IRS. If they don't have it, they could face penalties for not withholding enough tax or for not reporting payments correctly. So, in a way, by providing your W-8BEN, you're not just helping yourself, but you're also helping the U.S. entity that's paying you stay on the right side of the tax rules. It's a pretty big deal, honestly.

Finding and Handling Your W-8BEN Form

So, you know the `w8 meaning` and why it's important, but how do you actually get your hands on one and what do you do with it? First, you can download the form directly from the official IRS website. This is always the best place to get the most current version, as tax forms can sometimes change. You can usually find it by searching for "Form W-8BEN" on their site, or you can go to www.irs.gov/formw8ben for instructions and the latest information. It's a fairly straightforward process, you know?

Once you have the form, you'll need to fill it out carefully. It asks for basic personal details, like your name, address, and country of citizenship. You'll also need to provide your foreign tax identifying number, if you have one, from your home country. If you're claiming a tax treaty benefit, there's a specific section for that where you'll indicate your country of residence for tax purposes and the specific article of the treaty that applies. Take your time with this part, as accuracy is pretty important.

Here's a really crucial point about the `w8 meaning` and its handling: you do not send this form to the IRS. That's a common misunderstanding. Instead, you give this completed form directly to the withholding agent or payer—the U.S. individual or business that will be sending you income. They are the ones who need it to properly manage your payments and report them to the IRS. So, you just hand it over to them, and they take it from there, basically.

Tips for Getting Your W-8BEN Right

Getting your W-8BEN filled out correctly is pretty important to avoid any hiccups with your U.S. income. One of the biggest tips is to always use the most current version of the form. Tax rules and forms can change, so downloading it directly from the IRS website each time you need it ensures you're using the right one. This helps entities ensure compliance and avoid common mistakes, which is a good thing for everyone, you know?

Another helpful hint is to make sure all your information is consistent with your official documents. Your name should match your passport, and your address should be clear and complete. If you're claiming a tax treaty benefit, double-check that your country has a treaty with the U.S. and that you meet the conditions for the specific benefit you're trying to get. Sometimes, people overlook these small details, and they can cause delays, frankly.

If you're unsure about any part of the form or how a tax treaty applies to your situation, it's always a good idea to seek advice from a tax professional who understands international tax rules. They can help clarify the `w8 meaning` in your specific context and make sure you're filling out everything correctly. This can save you a lot of worry and potential issues down the road, which is pretty sensible, I think. You can also learn more about tax forms on our site, and link to this page for more detailed guidance.

Common Questions About the W-8BEN Form

People often have similar questions when they first come across the `w8 meaning` and the form itself. Here are a few common ones that come up, which might help clear things up for you too.

Do I need to get a new W-8BEN every year?

Not necessarily every year, but typically a W-8BEN form is valid for three calendar years from the date it's signed. For example, if you sign it on January 15, 2024, it would be good until December 31, 2027. However, if any information on the form changes, like your address or your tax residency, you need to submit a new one right away. So, it's not a yearly thing unless something changes, or the three years are up, you see.

What if I don't provide a W-8BEN form?

If you're a non-U.S. person receiving U.S. income and you don't provide a valid W-8BEN form to the payer, they generally have to withhold U.S. tax at a much higher rate, often 30%, on certain types of income. This is because they have no way of knowing your foreign status or if you qualify for any tax treaty benefits. So, you'd just get less money, which is obviously not ideal, you know?

Can I submit the W-8BEN form electronically?

Whether you can submit the W-8BEN form electronically depends on the payer. Some U.S. businesses and platforms have systems in place that allow for electronic submission, while others might still require a physical paper form with an original signature. It's always best to check with the specific entity that is asking you for the form to see what their preferred method is. They will tell you their process, basically.

Keeping Up with Your W-8BEN

Understanding the `w8 meaning` and how to handle the W-8BEN form is a vital step for anyone outside the U.S. receiving income from it. It's about more than just a piece of paper; it's about making sure your financial interactions with U.S. entities are smooth, compliant, and fair when it comes to taxes. By providing this form, you help ensure that the right amount of tax is withheld, potentially saving you money and avoiding future headaches. It really helps everyone involved, you know?

Remember that the purpose of this form is mainly to let brokers and mutual funds, and other U.S. payers, know your foreign status. This allows them to correctly apply tax withholding rules and avoid common mistakes on their end. It's a simple step that has a pretty big impact on how your U.S. income is processed, so it's worth getting it right.

If you're ever unsure or if your circumstances change, it's always a good idea to revisit the IRS website for the latest instructions or talk to a tax advisor. Staying informed about your W-8BEN responsibilities means you can keep your financial dealings with the U.S. running smoothly. So, take a moment to review your form if you have one, or get one if you need it, and make sure everything is current. It's just a smart thing to do, really.

W8 Download - Fill Online, Printable, Fillable, Blank | pdfFiller

Formulario W8: legalidad en cobros desde Estados Unidos • La Vida Freelance

Understanding Form W-8BEN: Purpose and When to Use It